There is an audible buzz in the real assets industry about Natural Capital, which is the institutional investment into natural resources such as forestry, agriculture, solar, and marine activities. It possesses attributes that real asset investors increasingly value; steady income, inflation tracking, and strong ESG credentials.

I’d like to explore a related idea in this post. We need to do better at appreciating what these same natural assets that do not sit within an institutional wrapper offer us. For example, the trees on the street where we live, the pond in the park where we walk the dog, the wild flowers on the A47 roundabout just past the McDonalds Drive Thru, or the sun which provides warmth to all of these.

I call this Public Realm Natural Capital or, for those natural assets on our own properties, Private Realm Natural Capital. There are too many natural assets to give them each due consideration in a short article such as this, and so today I will focus exclusively on just one of them: trees.

“Isn’t it good, Norwegian Wood”, The Beatles

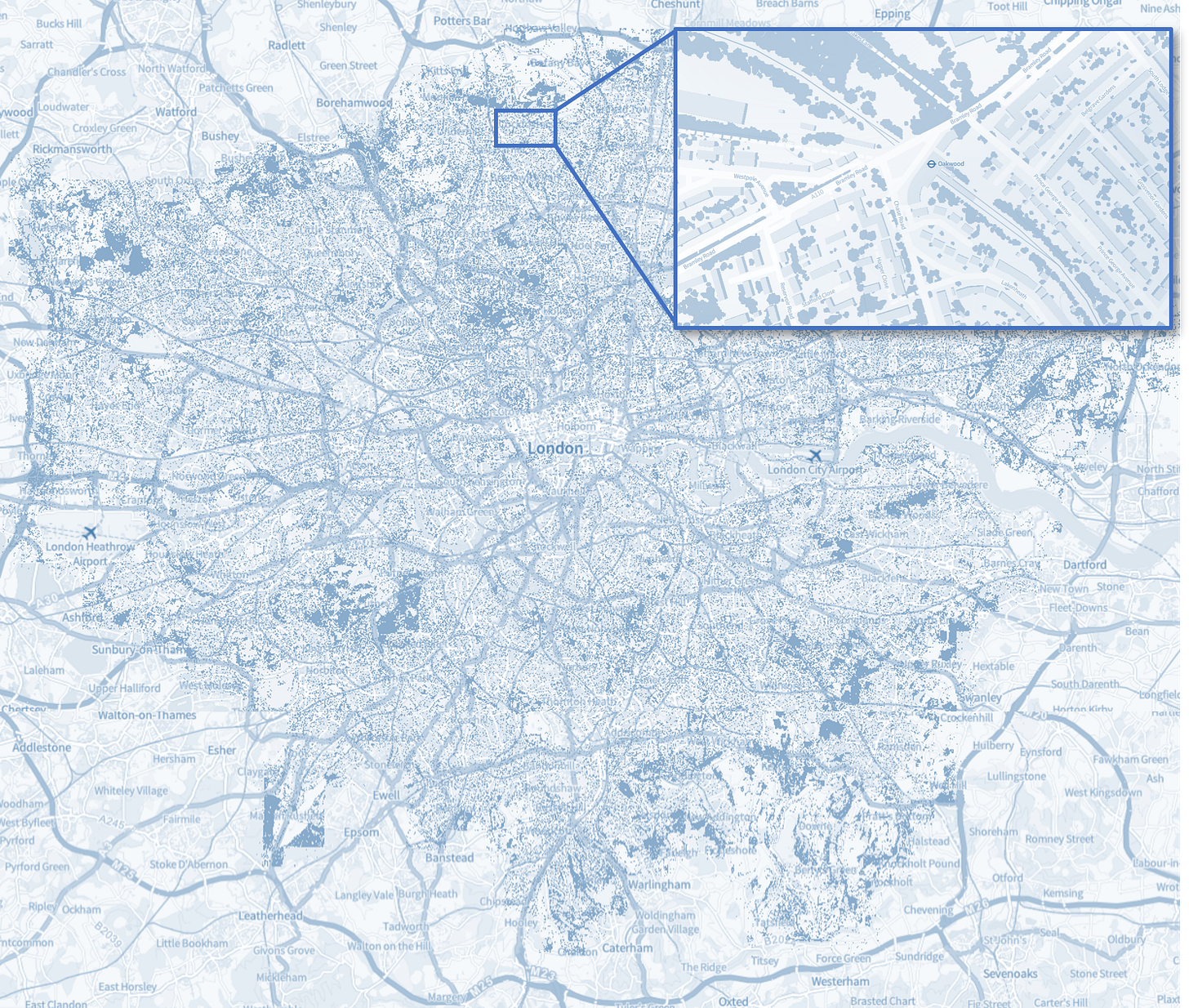

The remarkable tree canopy map below produced by Breadboard Labs in collaboration with the Greater London Authority marks the position of every single tree in Greater London as a dark blue dot. For the zoomed section, a subset of data that comes from a similar project by Friends of the Earth, I’ve selected an area not quite at random, called Oakwood. This demonstrates the remarkable granularity of the data; it vividly displays every tree in London - a total of 816,000 - with an estimated accuracy of 97%. As someone who often laments the lack of data available for my work, consider me suitably impressed.

The Woodland Trust estimates that 13% of the UK is covered by woodland. Friends of the Earth believe that this could be doubled without encroaching on high-value or protected land. A further 3% of Britain’s land is covered by trees on streets, hedgerows and farms.

In primary school we learn that trees exchange the carbon dioxide produced by us for life-giving oxygen. This is so fundamental to the well-being of the human race that it could serve as a sufficient argument in favour of tree preservation on its own. But there are many more lesser-known but crucial benefits that need mentioning. For example, trees play a crucial role in preventing soil erosion and flooding; the value of UK trees as flood water protection is c.£6.5 billion. They also provide a habitat that encourages biodiversity. And the UK’s trees store 213 million tonnes in carbon, and absorb more each year. Felling trees releases that carbon back into the atmosphere.

While the environmental benefits of Public & Private Realm Natural Capital are vital, this article also aims to explore the financial benefits. Let’s examine these, somewhat whimsically, as if they were institutional investments.

“Someone is sitting in the shade today because someone planted a tree a long time ago”, Warren Buffet

I’ll start with the indirect added value of Public Realm Natural Capital. It is common knowledge that owning or renting a property near a green space will cost you more than one that is not, all other things being equal. And with house price growth over time shown to be stronger for more expensive properties in recent decades, this is an entry price premium that should eventually pay you back, plus more.

According to an interactive study conducted by the Office of National Statistics in 2016, a detached house overlooking the large green space in the abovementioned Oakwood area of north London would have been worth 1.5% more than the same house set just 500 metres further back. Even just a view of green space or open water adds value to your home. Moreover, it appears that the larger the space, the more pronounced the impact.

What about for the Public Realm Natural Capital that is slightly too far away for your own home to see a direct uplift in value? It seems it could still be emotionally and financially worthwhile to pay that space a visit. People derive considerable enjoyment in visiting nature, with one in seven of all trips to the British countryside made to woodlands. This has been shown to reduce depression and anxiety, and Forest Research estimates that the UK’s woodlands contribute £185 million in reduced national healthcare costs each year. Although, as that only comes down to £2.75 per person, one of my takeaways here is that perhaps we shouldn’t look too hard to ascribe monetary value to everything that we enjoy.

“If I ever go looking for my heart’s desire again, I won’t look any further than my own backyard”, The Wizard of Oz

An estimated 57% of London’s trees are in private ownership, which falls within Private Realm Natural Capital. So, is there a way to engineer some added value for financial benefit from this?

First in real estate portfolio management comes risk mitigation and value protection. Although I am personally in favour of saving trees, removing dying ones or those with expansive roots that pose a threat to nearby houses is important. They otherwise risk incurring remedial costs or detracting from the value of your home.

Another method for enhancing investment returns is maximising net operating income through cost reductions. Maintaining healthy trees will help mitigate future treatment of diseased trees or removal of dead ones. London’s Oaks and Ash have a higher proportion of unhealthy specimens than other species, so be sure to check on them if these are on or near your property.

Utilities constitute 10% of a typical household budget, and maximising the efficiency of heating and cooling can save valuable operating expenditure. Various studies show that tree shade can reduce indoor temperatures by 2-3 degrees Celsius during hot summer months, protect from cold winter winds, and cut air conditioning running costs by 20-30%.

There are other hidden benefits too. It takes approximately 450 mature trees to fully offset the ten tonnes of carbon dioxide produced by the typical Brit each year. Having five trees in your back garden is sufficient to offset your carbon footprint from the 1st to the 4th of January each year. If you own 38 trees, that will take you through to the end of January. Admittedly, this is not going to move the needle on climate change, but it may make you think twice about removing a tree simply because you don’t like the look of it.

If you want to generate income from your Private Realm Natural Capital, then you’ll need a large enough woodland to sustainably generate timber for construction. Considering a more realistic scenario, a small plot of amenity woodland can generate a modest income locally from the sale of firewood or fruit. Both plots of land will need to be larger than the average garden though (40 sq m/1,500 sq ft), so you’ll have to purchase this elsewhere. But note that owning even a modest parcel of woodland sill come with costs; purchase fees, tamp duty, maintenance fees, drainage, transport etc.

“Birds singing in the sycamore trees, dream a little dream of me”, The Mamas & The Papas

Next is enhancing the value of your Private Realm Natural Capital through proactive tree planting. Whilst there will be a great many variable factors, trees have been shown to increase residential and/or land values by 5-18%. They do this through a number of tangible and intangible measures mentioned already, such as aesthetics, increasing biodiversity, noise reduction, air quality improvement, flood prevention, and pollution removal. New trees won’t immediately help with carbon storage, as that is done far better by mature trees.

When planting a new tree in your garden, choose species that are low maintenance and native to your local area:

If prestige is what you are after, you may choose to plant a regal Oak. This is also the top tree for carbon capture. However, be aware of its susceptibility to disease.

If your local climate is wet and absorbing rainwater is a priority, opt for a Sycamore.

If you’re in a ‘rush’ to sell your home, plant a majestic Willow instead, which grow at a rapid rate. This tree is also home to the most species of insect, important if biodiversity is your priority.

If year-round privacy is your priority, then an evergreen tree makes sense, and the tall, elegant Italian Cypress or the smaller Japanese tree privet will do well in this regard.

“What I want more than anything is to see a real living tree growing in my backyard”, The Lorax

It is comforting to think that there is both environmental and economic value to be found in the everyday trees that surround us. And that you don’t have to be invested in an institutional forestry fund to benefit from them, financially or otherwise.

The 1T.org Advisory Council estimates that we need to plant one trillion trees globally by 2030. Despite being known for its ‘green and pleasant land’, you may be surprised to learn that the UK is actually one of the least densely wooded countries in the world (although remarkably it does have enough hedgerows to circle the world ten times). Save the planet and make a financial return on your property? What are you waiting for?!

Note: This article should not be construed as investment or even gardening advice. For an expert opinion, please speak to your local financial or arboricultural professional.